Sky Peak Surveyor

"Taking your business to new heights with Sky Peak"

About us

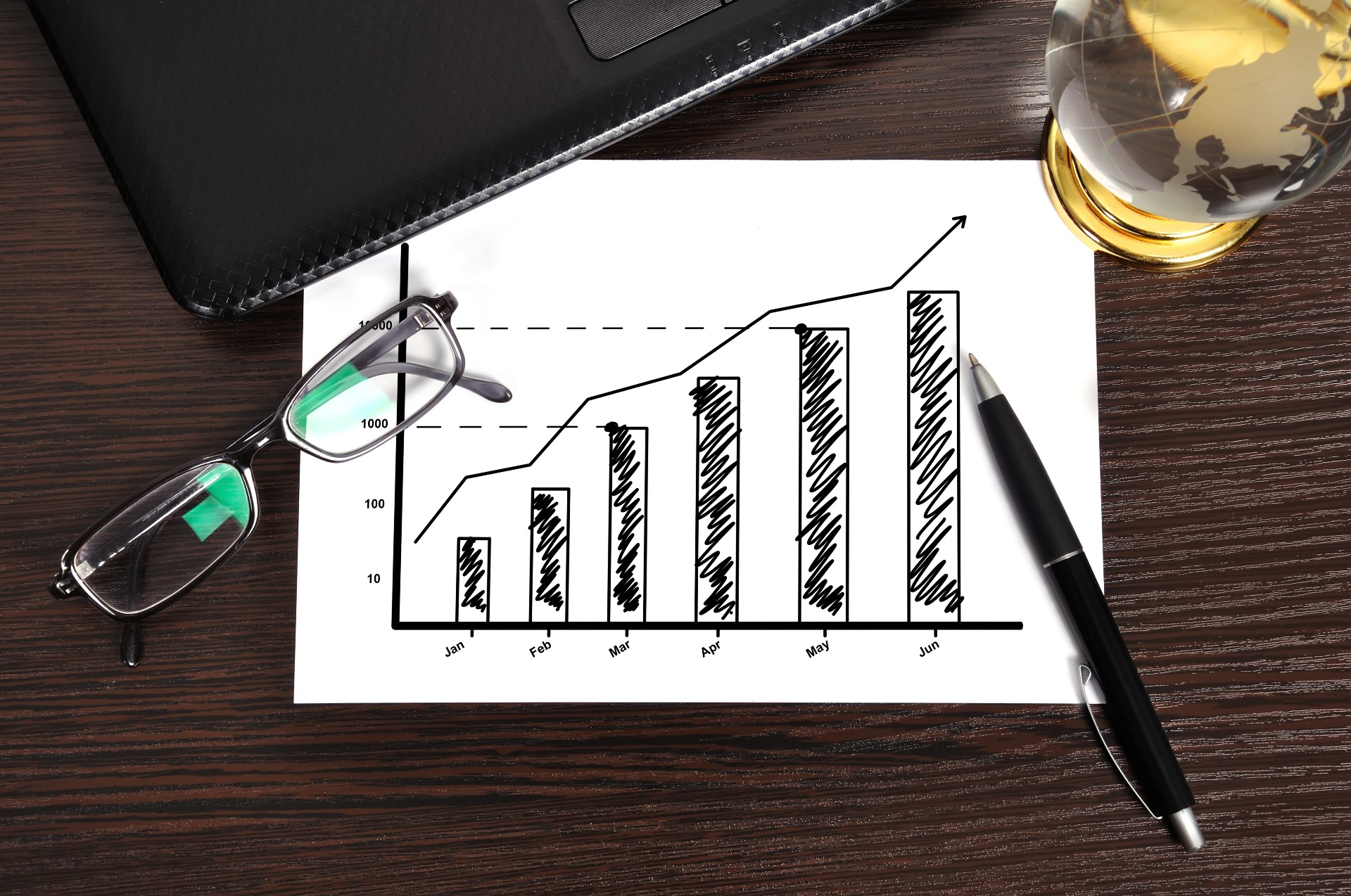

Sky Peak Surveyor specializes in providing high-quality Business Valuation Advisory services for a variety of purposes. Our team of experienced professionals is dedicated to helping businesses make informed decisions and fulfill their requirements by accurately assessing the value of their assets. We understand that every asset is unique, and therefore, requires a customized valuation approach. That's why we offer a range of services, including M&A transactions, purchase price allocation, financial reporting, tax planning, goodwill and asset impairment, and internal reference.

- Valuation Asset Scope: equity, bond/debt security, intangible asset, financial instrument, real estate and many other kinds of tangible and intangible assets

- We provide instant price quote on valuation request with a few multiple choice questions:-

Value for...

- Public Circular/Announcement

- Financial Reporting and Auditing

- Internal Reference

- Purchase Price Allocation

- Dispute/Litigation Related

- Read more

Professional Services

Business Valuation for M&A Transactions

Business valuation is the process of determining the worth of a company in order to facilitate mergers and acquisitions by providing a fair and accurate assessment of its value.

Goodwill & Assets Impairment Valuation

Goodwill and Asset Impairment Valuation involves assessing the value of a company's intangible assets and determining if they have been impaired in value, impacting the overall financial health of the organization.

Financial Reporting Valuation

Financial reporting valuation provides assessments of a company's assets and liabilities, helping to ensure transparent and reliable financial reporting for auditing as well as accurate purchase price allocation exercise.

Showcase

Valuation of a Convertible Bond issued by an IT infrastructure colgomerate for investor's reference. We utilized multiple valuation techniques, including discounted cash flow and market-based approaches, to determine a fair purchase price of the bond.

Valuing a convertible bond could mainly be divided into 2 parts, i.e. the bond and the share purchase option (Value of straight bond + Value of call option on the issuer's shares) . The bond part is a straight-forward discounted cash flow calculation with expected payout schedules according to the contract terms and an appropriate discounted rate after reseaching the latest bond market information. The option part involves research and due diligence on the industry to verify the projected cashflow of the bond-issuing company ("Target Company") for valuing the equity value of the Target Company which is the most significant component in the option pricing model.